Banking concentration

in Spain at the provincial level

Despite undergoing one of the most profound financial sector consolidation efforts within the EU, at the national level, the Spanish banking sector remains below the threshold level of a highly concentrated market, although a provincial-level analysis reveals higher levels of concentration. In this context, and amid profitability pressures, Spanish banks could still benefit from additional measures to increase efficiency.

Abstract: The Spanish banking sector stands apart in the European context for the intensity of its consolidation since the start of the crisis in terms of both the reduction in the number of competitors (having declined by 43%, compared to 28% in the Eurozone) and the increase in market concentration (measured using the Herfindahl index, concentration has increased by 88%, compared to just 5.1% in the Eurozone). Despite the sharp increase in sector concentration, albeit from a starting point below the European average, the nationwide reading is well below levels of concern from an antitrust standpoint. Even in the wake of the two bank mergers of 2017, the Herfindahl index stands well below the threshold used by the ECB to define a market as highly concentrated. At the subnational level, however, over half of Spain’s provinces present highly concentrated markets. Despite the intensity of restructuring and consolidation, sector returns remain slim relative to investor demands, which calls for further improvement in cost-income ratios. Recognizing that there is occasionally a trade-off between financial stability and competition, and that the latter may suffer in the interest of the former, there is scope for additional consolidation, including crossborder transactions, as welcomed by the ECB.

Introduction

Since the crisis broke out in 2008, the Spanish banking sector has undergone far-reaching consolidation, shaped by numerous mergers and acquisitions. As of September 2017, the number of credit institutions in Spain was 43% smaller than in 2008 (207 vs. 362), implying a far bigger reduction in the number of banks than in the eurozone as a whole, where the volume contracted by 28%. In parallel, concentration in the banking market has risen sharply, marked by an increase of almost 20 percentage points (pp) in the market share commanded by the top five entities (implying an increase of 19%, compared to 10% in the Eurozone) and of 440 points in the Herfindahl index (growth of 88.5%, compared to 5.1% in the Eurozone). Of the EU-28 member states, only Greece has a greater increase in banking concentration than Spain.

Analysis of bank concentration levels is part of the guidance used by the anti-trust authorities when authorising mergers and acquisitions. Their criteria include benchmarks for market concentration in absolute terms (unconcentrated; moderately concentrated; highly concentrated) and for changes in concentration levels. Specifically, the Herfindahl index (HI) is used to measure concentration. Therefore, we can say there is implicit concern over the effects that high concentration levels or sharp growth in concentration could have in terms of competition. There is extensive supporting evidence that concentration may not be a good indication of competition levels, as competition can be intense even in highly concentrated markets (for example, in the case of a duopoly). However, since the fewer the players (and the higher the concentration) the easier it is to collude, anti-trust authorities do pay attention to the consequences a merger will have on market concentration: if they determine that concentration would be high or significantly higher post-merger, they analyse the transaction in greater depth. Hence the importance of analysing the changes that have taken place in the concentration of the Spanish banking market as a result of the sector restructuring that has taken place in recent years.

Despite the intense increase in bank concentration in Spain, concentration at the nationwide level is far below what is considered worrisome. In terms of the HI, the reading of 937 points as of the end of 2016 is below the threshold of 1,000 above which the ECB considers a market to be moderately concentrated and is barely over half of the threshold of 1,800 above which market concentration is considered high.

However, the bank concentration snapshot changes when looked at from a regional standpoint and some entities compete at just such a regional level. This is the situation facing credit institutions whose business is concentrated in just a few regions or provinces. That is why the anti-trust authorities also monitor the consequences of mergers and acquisitions on regional markets (autonomous regions and provinces in the case of Spain).

Against this backdrop, the author presents this paper, written as part of the Spanish Ministry of Science and Innovation and Generalitat Valenciana research projects. The goal is to measure bank concentration in Spain, building indicators at the regional level, and to compare the situation in 2016 with that of 2008 in order to analyse the impact of the mergers and acquisitions that have taken place in the interim. To measure activity levels, we use the number of branches of each deposittaking institution (banks, savings banks and credit cooperatives) in each province, as this is the only variable for which there is public information by region and entity. In addition, given that there were two transactions in 2017 (the acquisition of Banco Popular Group by Banco Santander and the merger of BMN into Bankia), we also simulate the impact of these deals on market concentration at the national and provincial levels.

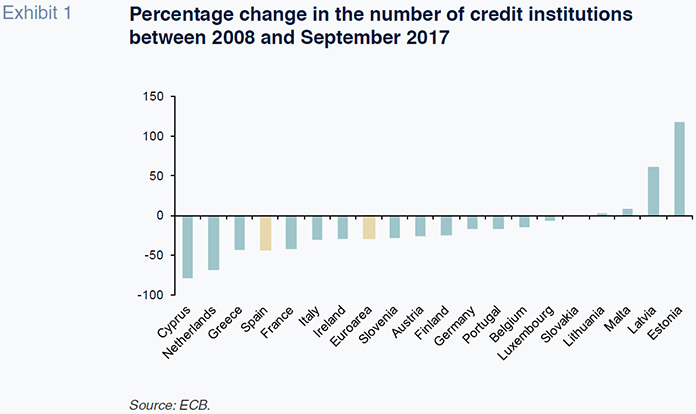

Concentration of the Spanish banking market in the European contextAs mentioned in the introduction, the number of Spanish credit institutions has fallen by 43% since 2008, which is a far bigger contraction than has been witnessed at the broader Eurozone level (28%)

[1]. In fact, of the 19 countries comprising the Eurozone, Spain ranks fourth in terms of the drop in the number of competitors, trailing only Cyprus, the Netherlands and Greece. The number of credit institutions has nevertheless fallen in the vast majority of countries, contracting by 42% in France, 30% in Italy and 17% in Germany. Germany has the largest number of banks (1,643), followed by Italy (569) and then France (422), compared to 207 in Spain.

Spain has few credit institutions relative to its population, as there are 224,848 inhabitants per bank, which is more than triple the Eurozone average (67,341). Of the Eurozone members, only Greece presents a higher ratio of inhabitants-to-banks than Spain.

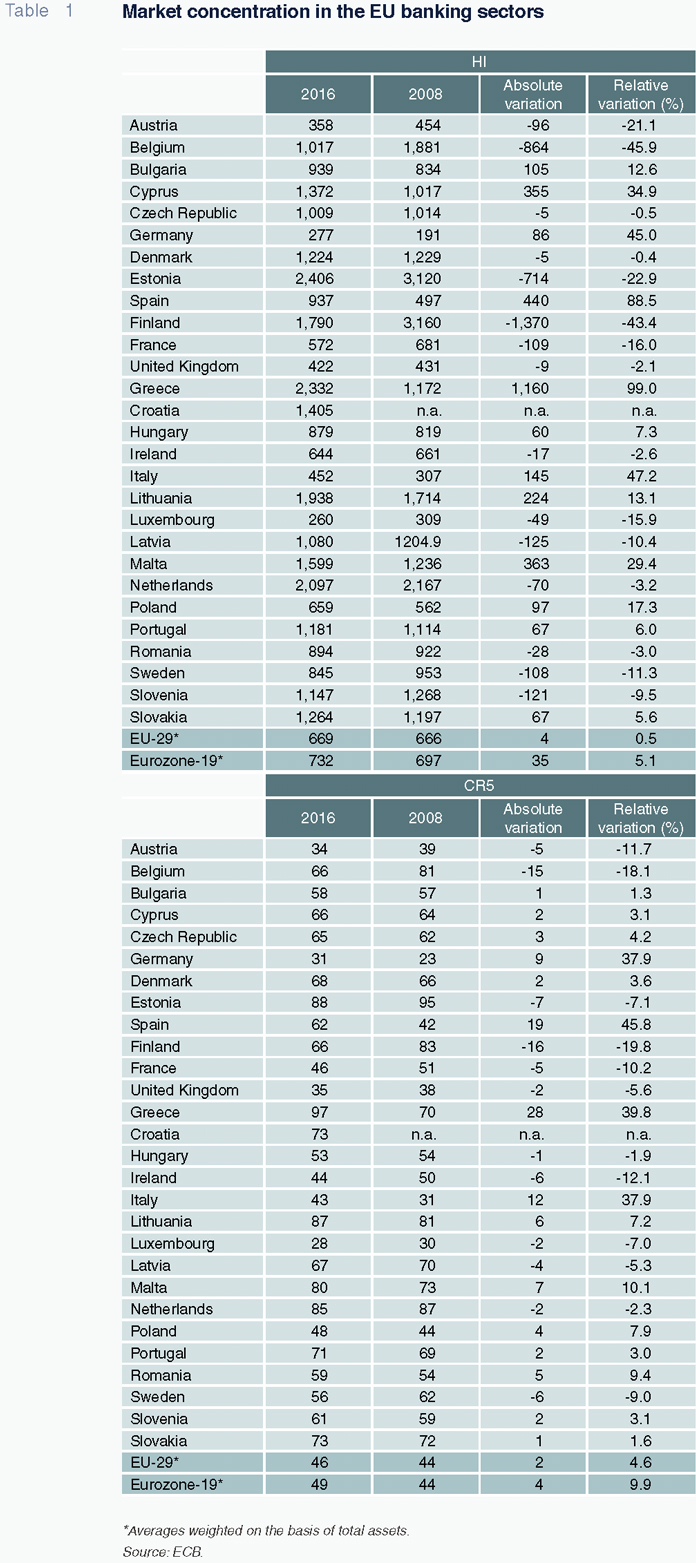

The relatively bigger reduction in the number of credit institutions in Spain has given rise to a more intense increase in banking market concentration. Specifically, in terms of the market share of the five largest entities, concentration has increased by 46%, namely from 42.4% in 2008 to 61.8% in 2016. During the same period, average concentration (weighted by total assets) across the Eurozone nations increased by 4.6% (9.9% in the case of the EU) to 48.9% (46.3%). By this measure, therefore, as of 2016, concentration in Spain was 12.9 pp higher than in the Eurozone (and 15.5 pp higher relative to the EU), whereas in 2008 it was 2.1 pp lower (and 1.8 pp lower than in the EU). The larger economies tend to have less concentrated banking markets, Spain presenting higher concentration than its large peers (31.4% in Germany; 43% in Italy; and 46% in France).

Measuring concentration using the so-called Herfindahl index

[2] (HI) has the benefit of factoring in all competitors in a market and not just the top 1, 3 or 5, etc. As a result, it tends to be the benchmark used to analyse market concentration. In its reports on the banking sector, the ECB (2017a) states that “As a general rule, an HI below 1,000 signals low concentration, while an index above 1,800 signals high concentration.

For values between 1,000 and 1,800, an industry is considered to be moderately concentrated”

[3].

As shown in Table 1, since the start of the crisis in 2008, the Spanish banking market has become far more concentrated, its HI having increased by 88.5%. That increase is significantly higher than the European (weighted) averages. In the EU-29, concentration has increased by 0.5%, while in the Eurozone it has risen by 5.1%.

Using the latest data available, which date to 2016, the Spanish banking market is significantly more concentrated than the European averages, in stark contrast with the situation observed in 2008. Specifically, Spain’s HI is 28% higher than the Eurozone average (937 vs. 732) and 40% higher than the EU-29 average (937 vs. 669). In contrast, in 2008, concentration in Spain was 29% and 25% lower than the Eurozone and EU-29 averages, respectively.

If we analyse the situation using the HI thresholds referred to by the ECB (2017a), bank concentration in Spain is low, at under 1,000 points. It is only high in four countries (Lithuania, Netherlands, Greece and Estonia), while eleven countries present moderately concentrated markets (Czech Republic, Belgium, Latvia, Slovenia, Portugal, Denmark, Slovakia, Cyprus, Croatia, Malta and Finland). The larger economies present lower concentration levels. As a result of these readings, using the ECB’s criteria, there is room for manoeuvre in terms of additional mergers and acquisitions in a good number of European banking sectors (including that of Spain) without necessarily giving rise to antitrust concerns.

Banking concentration in Spain: The regional dimension

The concentration indices analysed thus far have been calculated at the national level based on the market shares of the various credit institutions in each country. Implicit to their construction is the assumption that this is the market in which they are competing.

This may be a reasonable assumption for a large number of entities which, on account of their size, tend to be present in a significant part of the various national territories. However, it is not so reasonable for entities which do not compete nationwide, but rather in just a few regions or provinces or even on occasion (small-sized entities), just the one. Several Spanish deposit-taking institutions fall into this category, judging by the distribution of their branch networks.

For this reason, it is worth analysing concentration in the banking market in Spain at the provincial level, building the concentration indices at this level. Limited publicly available information means that the only way to do this is to use branch network figures, as there is no public information at the entity level for business activity in geographical areas smaller than the national market. Given that the three sector associations (banks, savings banks and credit cooperatives) provide the breakdown by province of the branch networks of each entity in the statistics they report annually, we can use this information to construct concentration indices by province.

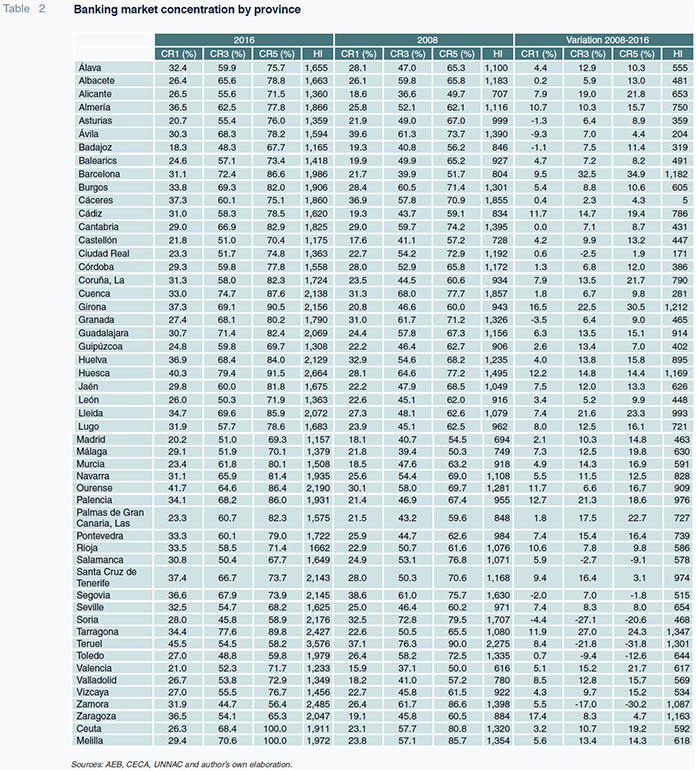

In terms of the market share of the biggest entity (CR1), the difference between the highest and lowest readings has widened across the provinces between 2008 and 2016, namely from 23.8pp in 2008 to 27.2pp in 2016 (Table 2). In 2016, Teruel was the Spanish province presenting the highest concentration of banks (just one entity has 45.5% of the branches in this province), while Badajoz was the least concentrated (18.3%). In addition to Teruel, Huesca and Ourense stand out for being highly concentrated (presenting levels of over 40%). Comparing the situation in 2008 with that of 2016, the greatest increases in the CR1 reading took place in Zaragoza (an increase of 17.4 pp), Girona (16.5 pp), Huesca (12.2 pp), Palencia (12.7 pp), Tarragona (11.9 pp), Cádiz (11.7 pp), Ourense (11.7 pp), La Rioja (10.6 pp) and Almería (10.7 pp). Concentration has increased in all but five provinces.

Looking at the market share commanded by the five largest institutions (CR5), the indicator reported by the ECB at the national level, this metric has increased in 47 of Spain’s 52 provinces, notably increasing by more than 30 pp in Barcelona and Girona. Huesca emerges as the most highly concentrated province by this measure (91.5%), followed by Girona (90.5%) and Ceuta and Melilla (100%).

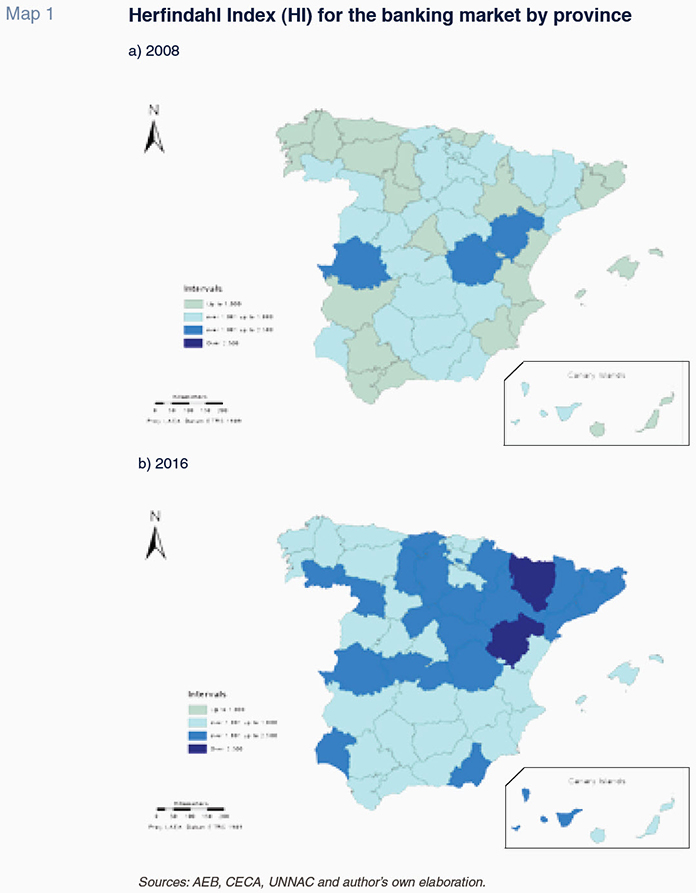

The HI is of greater value in assessing market concentration due to the existence of benchmark thresholds. This index has increased in all 52 provinces since 2008 and by over 1,000 points in the cases of Barcelona, Girona, Huesca, Tarragona, Teruel, Zamora and Zaragoza. In percentage terms, the index has more than doubled in Barcelona, Girona, Palencia, Tarragona and Zaragoza.

The range in readings for this index in 2016 runs from a low of 1,157 in Madrid to 3,576 in Teruel, indicating the existence of very pronounced differences in concentration levels at the provincial level in Spain. There are 28 provinces below the threshold for moderate concentration according to the ECB (1,800 points). The remaining 24 provinces exceed this threshold, indicating the existence of highly concentrated markets. Teruel is the province with the most concentrated banking market with an index of 3,576 points. Above the 2,000 mark are Zaragoza, Guadalajara, Lleida, Huelva, Cuenca, Santa Cruz de Tenerife, Segovia, Girona, Soria, Ourense, Tarragona, Zamora and Huesca. The least concentrated banking markets are found in the provinces of Madrid, Badajoz, Castellón and Valencia. Note that two provinces present concentration indices of over 2,500 points (Teruel and Huesca), the threshold used in the EU to delimit an excessively concentrated market.

The impact of the mergers of Banco Popular into Banco Santander and of BMN into Bankia

Two deals have closed in 2017 which have the effect of increasing concentration in the Spanish bank market. The purchase of Banco Popular by Banco Santander has a bigger impact than the merger of BMN into Bankia, as the former involves the largest and fifthlargest banks in Spain, respectively, while the merged entity in the latter deal is of a much smaller size.

In order to analyse the impact of these two deals on market concentration, we first simulate their impact at the national level using total assets as our indicator of business activity levels. We then simulate the impact at the provincial level, in this instance using the branch footprint data.

Using information gleaned from the individual balance sheets reported by the three sector associations referred to earlier in this paper, the HI in 2016 was 1,057 points in terms of total assets

[4]. However, if we layer in the impact of the two mergers closed in 2017, the HI increases to 1,338 points. Factoring in only the acquisition of Popular, the HI increases to 1,311. Accordingly, in this instance, concentration increases by 281 points.

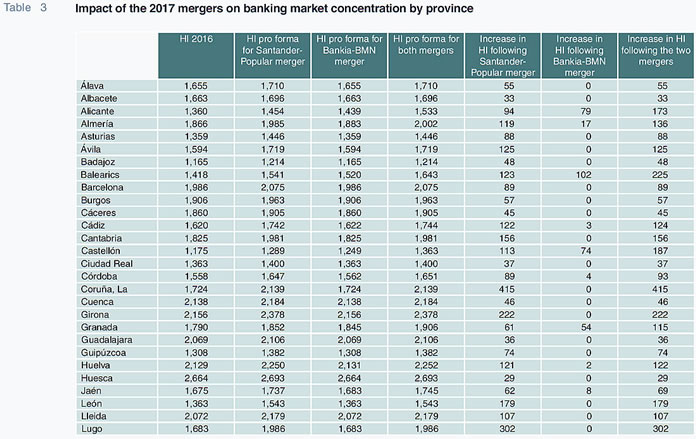

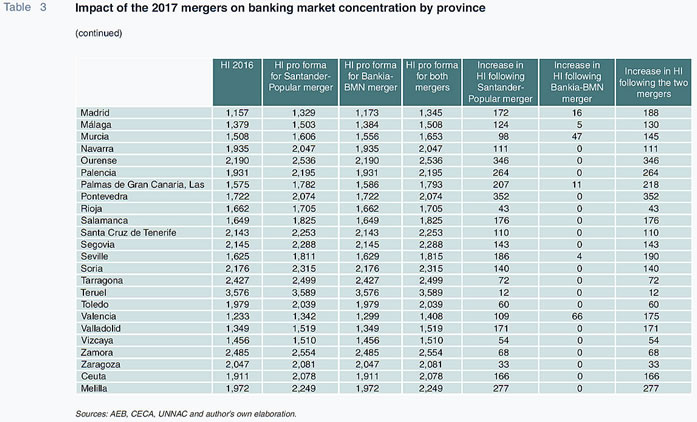

Turning to the impact of the two mergers at the provincial level, Table 3 simulates the HI in three scenarios: a) after the merger of Popular into Santander; b) after the merger of BMN into Bankia; and, c) after the two mergers.

In the first instance, concentration increases in all provinces by between a minimum of 12 points in Teruel and a maximum of 415 points in La Coruña. In eight provinces (Palmas de Gran Canaria, Girona, Palencia, Melilla, Lugo, Ourense, Pontevedra and La Coruña), concentration increases by more than 200 points, and in another 20 by between 100 and 200 points

[5].

Using the merger guidance criteria used in the US since 2010, concentration levels increase by more than 100 points in 13 provinces, in some instances starting from indices of over 1,800 and in other indices of over 2,500. Those provinces are the following: Lleida, Santa Cruz de Tenerife, Navarra, Almería, Huelva, Soria, Segovia, Cantabria, Ceuta, Girona, Palencia, Melilla and Ourense. In this instance, using the US guidance, the merger would warrant further scrutiny. The HI does not increase by more than 200 points in any highly concentrated market (markets with a HI of > 2,500 points), a situation which would have implied enhanced market power.

In the case of the merger of BMN into Bankia, the HI increases by more than 100 points (specifically, 102) in just one province, namely the Balearics. It increases by between 50 and 100 points in Alicante, Castellón, Granada and Valencia.

If we look at the combined effect of the two mergers, it is worth noting the increase in the HI in the provinces in which each of the two mergers separately increases the index by more than 50 points: Alicante, the Balearics, Castellón, Granada and Valencia. However, because the Popular-Santander transaction has the greatest impact on concentration, the biggest increases in concentration levels are attributable to this merger.

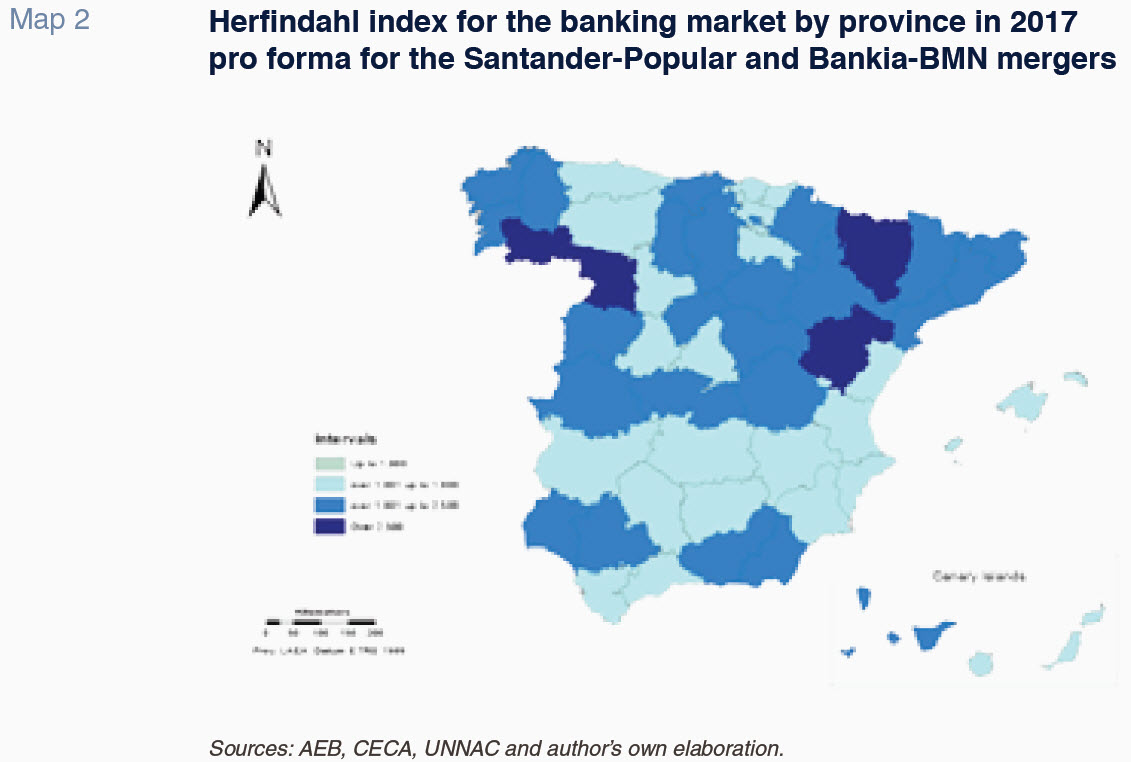

As shown in Map 2, the most recent snapshot (in the wake of the two mergers of 2017) of concentration in the Spanish banking market at the provincial level reveals that 30 Spanish provinces present highly concentrated bank markets, marked by Herfindahl indices above the 1,800 threshold established by the ECB. Using the more stringent criteria used in the US, in four provinces (Huesca, Ourense, Teruel and Zamora) the index stands above 2,500 points, indicating the existence of a highly concentrated market.

Reflections on the outlook for concentration in the Spanish banking market

The Spanish bank sector has undergone profound restructuring in recent years, reorganisation that was necessary to correct the imbalances of the past and render the sector less vulnerable. This restructuring work has led to sector consolidation that has translated into a smaller number of competitors and, by extension, an increase in market concentration. In fact, in the European context, Spain stands out as one of the countries in which concentration has increased, the number of competitors declined and installed capacity decreased most significantly

[6].

Despite the intense restructuring and consolidation, sector returns in Spain remain slim in relation to investor demands [7]. This is why institutions such as the Bank of Spain (2017) and the IMF (2017) recommend enhancing cost-income ratios, which requires scaling back installed capacity further. And there is still scope to do so considering that fact that the density of Spain’s bank branch network remains among the highest in the EU (1,613 inhabitants per branch compared to an average of 2,278 in the Eurozone); moreover, Spain’s branches are smaller than their EU counterparts in terms of jobs per branch (6.5 versus 15.6 in the EU). The necessary downsizing will be easier to carry out if accompanied by mergers and acquisitions designed to unlock synergies and economies of scale among the entities involved.

From the anti-trust standpoint, the fact of continuing sector consolidation is not in theory of concern given that market concentration levels are currently moderate and far below the threshold used to delimit a highly concentrated market [8]. Even in the wake of the two bank mergers of 2017, the Herfindahl index stands at 1,338 points, well below the threshold of 1,800 used by the ECB to define a market as highly concentrated. Nevertheless, going forward, more cross-border transactions would be welcome in the context of European banking union, as indeed the ECB has called for (2017b), since these mergers do not imply an increase in concentration within national markets and therefore do not have adverse effects in terms of competition.

In light of the evidence provided in this article, the analysis of bank concentration at the national level should be complemented by analysis at the regional level, at which, as we have seen, there are instances of highly concentrated markets. It is well known that there is sometimes a trade-off between financial stability and competition and that the latter may suffer in the interest of the former. Nevertheless, it would be advisable to complement the analyses performed at the national level with studies at the regional level in order to ensure minimum levels of competition in all markets.

Notes

As revealed in a recent ECB report (2017), the number of credit institutions (individual entities) in the eurozone has fallen from 6,768 in 2008 to 5,073 in 2016. In the case of consolidated groups, the population has decreased from 2,904 to 2,290 (by 21%). These figures include the entities established in the various countries as foreign branches. In Spain, of the 207 credit institutions remaining in 2016, 82 are in the form of foreign branches.

The Herfindahl index (HI) is calculated by squaring the market shares of all of a country’s credit institutions and summing the resulting numbers. The highest possible reading is 10,000, which represents a monopolistic situation.

In the US, until 2010, the Department of Justice (2007) used the same thresholds as the ECB. 1,800 points was the threshold above which concentration was considered high. That guidance was revised in 2010 and new thresholds introduced such that: a) an index reading of under 1,500 indicates an unconcentrated market; b) a reading of between 1,500 and 2,500 indicates a moderately concentrated market; and, c) a reading of over 2,500 indicates a highly concentrated market. In the first instance, a merger or acquisition does not require further analysis. In the second, a more detailed scrutiny is required if the index increases by more than 100 points as a result. And in the third instance, an increase of more than 100 points warrants more in-depth analysis, while an increase of over 200 points is presumed to be likely to enhance market power.

The ECB reports a slightly lower number of 937.

The European Commission report (2017) on the merger of Banco Popular Group into Banco Santander states that the provinces most affected in terms of the retail business by the merger are Cantabria, La Coruña and Ourense where the combined market shares of the two banks range between 30% and 40%.

Almost half of the branches closed in the Eurozone since 2008 were located in Spain. In terms of jobs, Spain is responsible for one third of the sector.

The data offered by the ECB in its ‘Consolidated banking data’ database indicates that the return on equity (ROE) reported by the Spanish banks in 2016 was 5% (versus a eurozone average of 3.7%), compared to an estimated cost of capital of at least 8%.

Moreover, the Spanish banks stand out in the European context for their commendable cost-income levels, so that relatively higher concentration has not implied a drag on efficiency.

References

BANK OF SPAIN (2017), Annual report, 2016.

EUROPEAN CENTRAL BANK (2017a), Report on financial structures.

— (2017b), Financial integration in Europe.

EUROPEAN COMMISSION (2017), Case M.8553 – Banco Santander / Banco Popular Group, DG Competition.

INTERNATIONAL MONETARY FUNC (2017), Spain. Financial System Stability Assessment, October.

US DEPARTMENT OF JUSTICE (2007). Horizontal Merger Guidelines.

— (2010). Federal Antitrust Agencies Issue Horizontal Merger Guidelines, Revised Horizontal Merger Guidelines.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF. This article was written as part of the Spanish Ministry of Science and Innovation (ECO2013-43959-R) and Generalitat Valenciana PROMETEOII/2014/046 research projects